|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

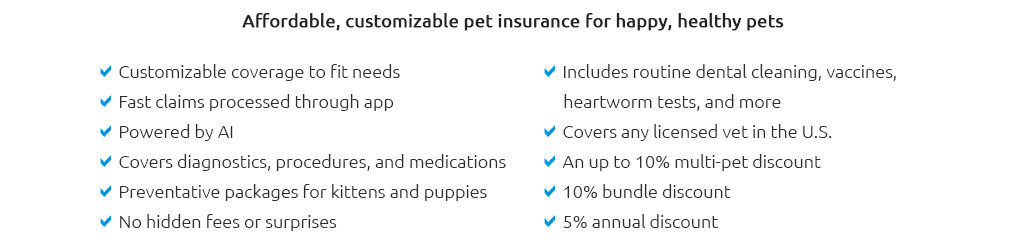

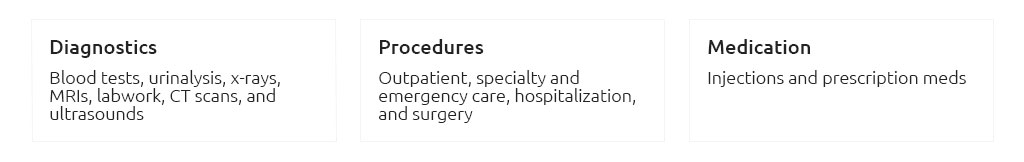

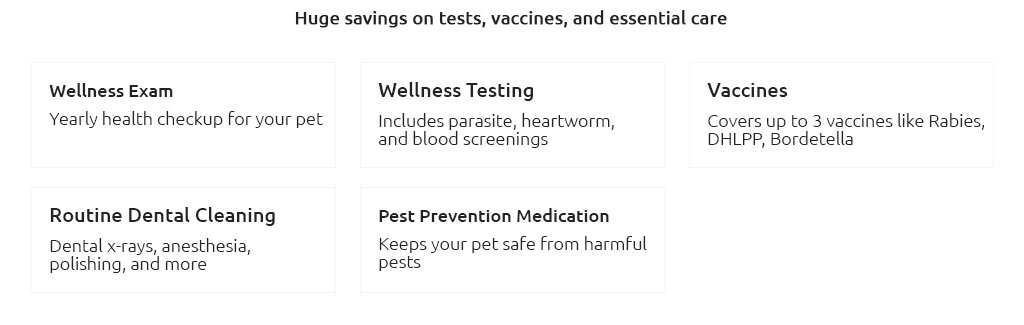

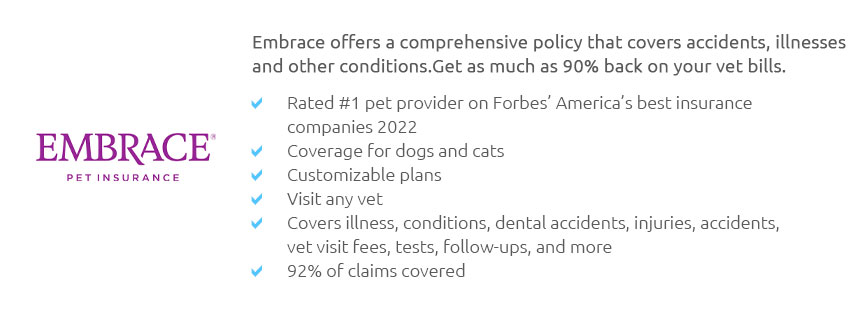

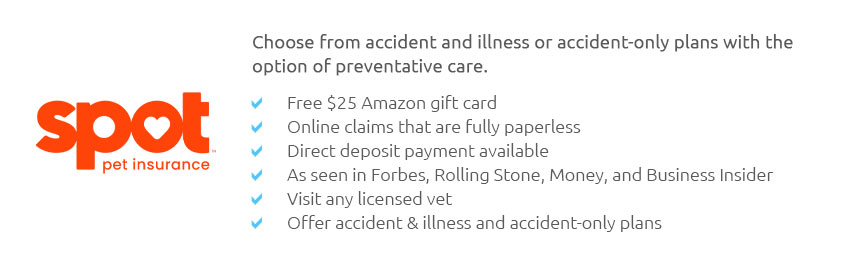

Exploring the Landscape of Pet Insurance Public CompaniesPet insurance has become an increasingly popular option for pet owners looking to safeguard their beloved animals' health and well-being. Public companies in this sector are playing a pivotal role in providing comprehensive and reliable coverage options. Key Features of Pet Insurance Public CompaniesPublic companies in the pet insurance sector offer a range of coverage options tailored to meet diverse needs. These companies often provide a variety of plans, including accident-only, illness, and wellness coverage. Accident and Illness CoverageAccident and illness coverage is a fundamental feature offered by many pet insurance public companies. It typically includes veterinary bills, hospital stays, and necessary treatments. Wellness PlansMany companies also offer wellness plans that cover routine care such as vaccinations, dental cleanings, and regular check-ups. These plans ensure that pets receive preventive care, reducing the risk of future health issues. Advantages of Choosing a Public Company for Pet InsuranceOpting for a public company for pet insurance comes with several benefits, including financial stability, transparency, and broader service networks.

For those in specific regions, exploring local options can be beneficial. For example, pet owners can check out pet insurance in Missouri to find plans tailored to their area. Choosing the Right Pet Insurance PlanSelecting the right pet insurance plan involves considering various factors, including the pet's age, breed, and health status, as well as the owner's budget and coverage needs. Factors to Consider

For those residing in different locales, understanding specific state regulations and options is essential. For instance, exploring pet insurance in New Mexico can provide insights into local insurance options. FAQ SectionWhat is pet insurance?Pet insurance is a policy purchased by pet owners to cover the veterinary costs incurred due to their pet's illnesses or accidents. It helps mitigate the financial burden of expensive medical treatments. Why choose a public company for pet insurance?Public companies offer financial stability, transparency, and extensive service networks, providing peace of mind to policyholders that their claims will be honored. Are there different types of pet insurance plans?Yes, there are various types of plans, including accident-only, illness, and wellness plans, each catering to different aspects of pet healthcare needs. https://www.fool.com/investing/stock-market/market-sectors/financials/insurance-stocks/pet-insurance-stocks/

3. Trupanion. Unlike Lemonade and Synchrony, Trupanion focuses exclusively on the pet insurance market. It's also been in the market the longest, with more than ... https://www.benzinga.com/money/pet-insurance-stocks

A few of the pet stocks of the stores that offer the general public pet insurance stocks are Chewy, Freshpet, Petco and the Original Bark Company. Chewy's ... https://finance.yahoo.com/news/15-best-pet-insurance-companies-182457839.html

The Allstate Corporation (NYSE:ALL) is one of the biggest insurance companies in the United States. It is also one of the best auto insurance ...

|